Coshare (KFH)

From Internal

(Difference between revisions)

(→Pre Sales checking) |

(→Factor Coshare 4.99% / 5.99% - 100%) |

||

| (3 intermediate revisions not shown) | |||

| Line 14: | Line 14: | ||

* Interest Rate: | * Interest Rate: | ||

** 2 to 5 years: 5.99% | ** 2 to 5 years: 5.99% | ||

| - | ** 6 to 20 years: | + | ** 6 to 20 years: 3.99% |

| - | * Payout: | + | * Payout: 97% - 1 month installment |

* Tenure: Min 2 years - Max 20 years | * Tenure: Min 2 years - Max 20 years | ||

* Employment Status: Work for at least 1 year | * Employment Status: Work for at least 1 year | ||

| Line 101: | Line 101: | ||

== Factor Coshare 4.99% / 5.99% - 100% == | == Factor Coshare 4.99% / 5.99% - 100% == | ||

| + | |||

| + | 2012-12-21: The following table no longer applicable, we will update soon. | ||

{| class="wikitable" style="text-align:center" | {| class="wikitable" style="text-align:center" | ||

| Line 166: | Line 168: | ||

* Loan Eligible = Available Deduction x Factor | * Loan Eligible = Available Deduction x Factor | ||

* In Hand = Loan Eligible x 100% | * In Hand = Loan Eligible x 100% | ||

| + | |||

| + | == Calculation Sheet & Repayment Table == | ||

| + | [[Media:COSHAREKFH-.xls]] | ||

Latest revision as of 07:49, 21 December 2012

Contents |

Pre Sales checking

- To assist in speeding up the process, just email us at coshare@msssb.com for Pre Sales Checking. Attached together the following documents:

- Option Letter for customer over 55 years. (if necessary)

- Redemption Settlement (RS) for Overlap Case (if necessary)

- We will inform you within 4-5 working days on the eligibility.Once you have obtained the approval,

you have to submit the complete full set of documents to us to process for submission.

Product Features

- Location: Whole Malaysia

- Interest Rate:

- 2 to 5 years: 5.99%

- 6 to 20 years: 3.99%

- Payout: 97% - 1 month installment

- Tenure: Min 2 years - Max 20 years

- Employment Status: Work for at least 1 year

- Finance: Min RM5,000 to RM200,000

- TAT: 2 - 3 weeks

- Salary: RM1,000 and above only

- Age: 19 years and above

- Expired Facility: 60 years old

- Yuran: Waived

- Blacklist: RM25,000 and below (Above RM25,000 - REJECT)

- CCRIS: Waived

Special Remarks

- Deduction 75%(ada pinjaman perumahan di payslip)- Mesti attach surat dari bahagian gaji-AG customers dan polis tak layak

- For 2nd account (2nd financing application without overlapping with the current KFH financing) is already approved.Kfh customers are no longer need to overlap with current KFH account before applying with new one.Customers now able to apply for 2nd account with conditions:

- Deduction for the first account is already appearing in customers payslip.

- Please indicate "2nd Account" at Borang Semakan Utama upon submission to us.

- Still eligible for applying new financing.

Opsyen Calculation

- Expired Facility in opsyen 60 years old.

- Example : 2011 - 1965 = 46

- Take 60 - 1 year - 46 = 13 years.

- This customer is eligible for 13 years only.

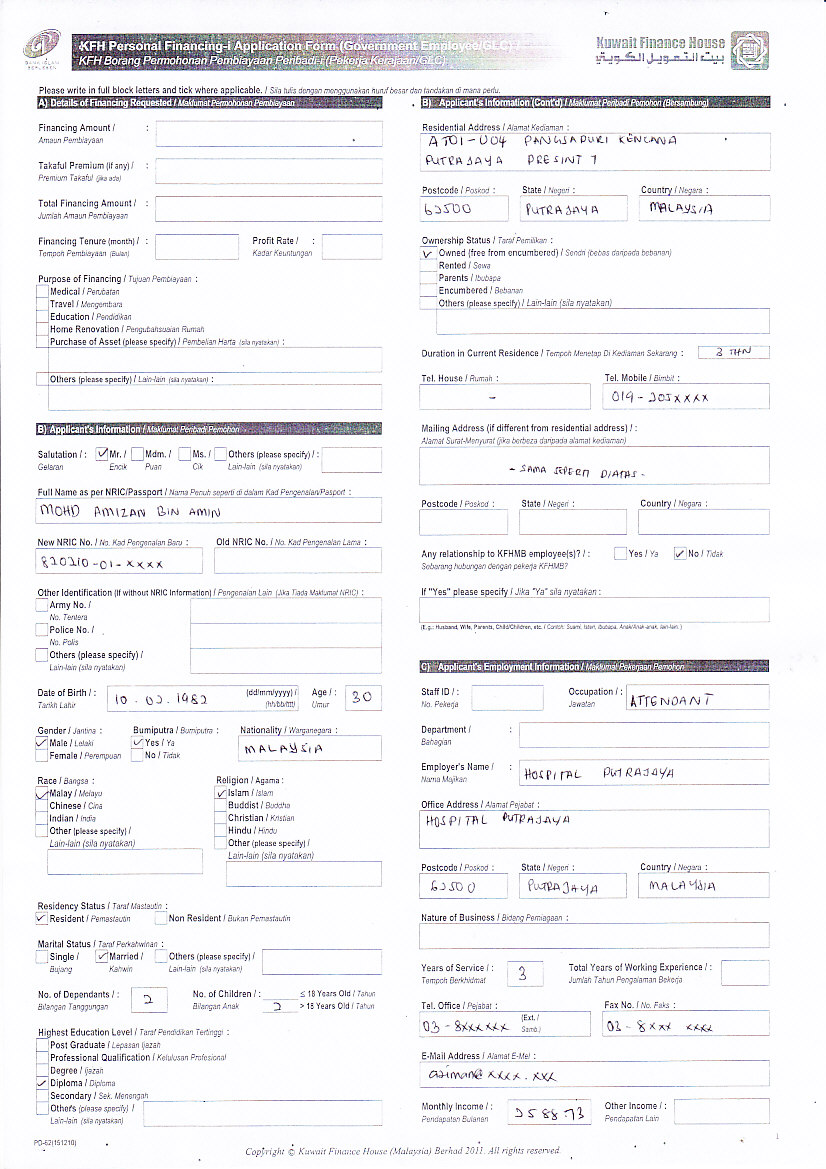

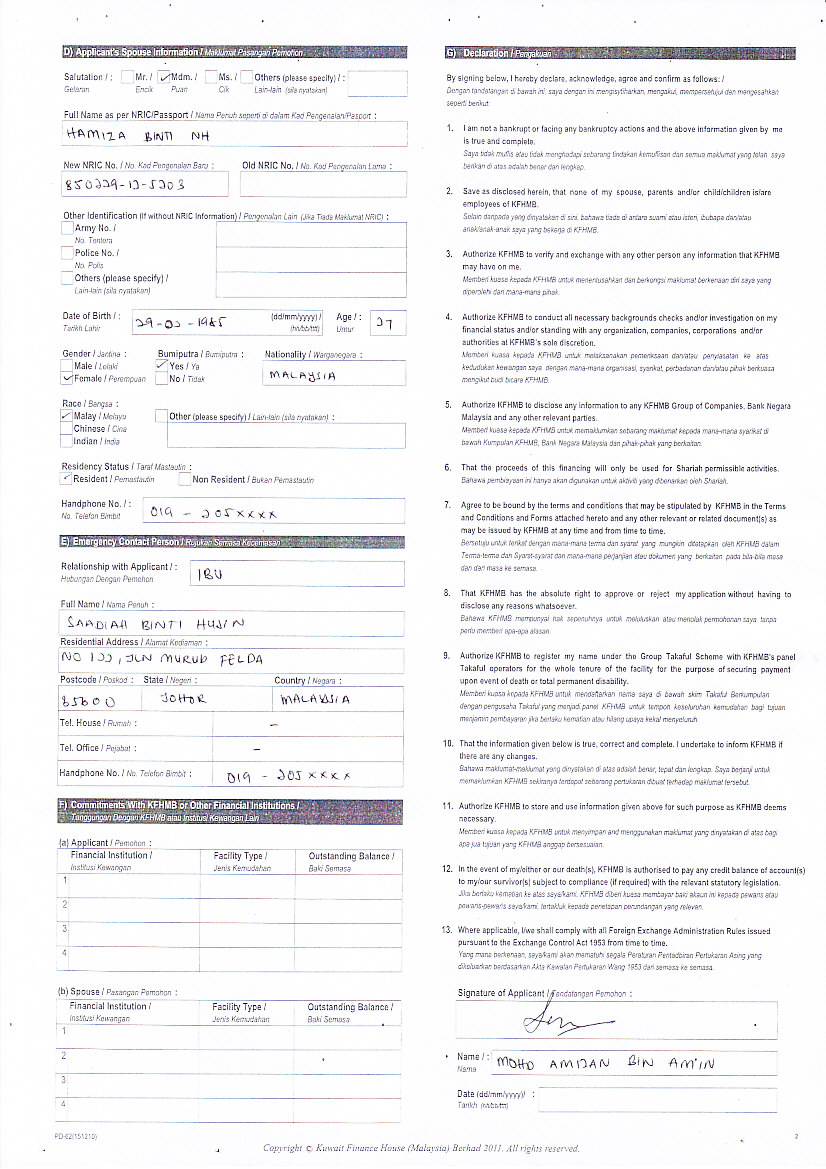

Document List

- Senarai Semakan Utama

- Borang CS/PGP-1 atau CS/PGP-2

- Permohonan Pembiayaan

- Borang Pemberitahuan Permohonan

- Borang Pemberitahuan Tawaran

- Surat Agensi

- Surat Makluman

- Borang Pengesahan Butiran Jawatan

- Arahan Penyelesaian Pembiayaan Sedia Ada

- Borang AkuJanji Penentuan Had Kelayakan Pembiayaan

- Borang Kebenaran Mengenakan Fi Perkhidmatan

- Slip gaji sebenar yang terkini(Original & Salinan) - 1+3 Copies

- Salinan Slip Gaji 2 bulan seterusnya

- Salinan Kad Pengenalan/Polis

- Salinan Surat Beranak(Untuk Polis Sahaja)

- Bil Utiliti Asal Terkini(Bil Elektrik/Air/Tel) - Not Compulsary

- Salinan Buku Bank

- Penyata Penyelesaian Pinjaman Institusi Kewangan Lain

- Borang Opsyen / Surat Lanjutan Perkhidmatan

- Borang GDBR

- Borang KYC (Know Your Customer)

Target Market

- All AG

- PDRM

- State AG (yang ada di MSS System > Department Report)

- Majlis (yang ada di MSS System > Department Report)

- Lain-lain (yang ada di MSS System > Department Report)

- Polis - 50% (Untuk 60% perlu surat Kebenaran 60% dari unit gaji)

Payslip Expiry Date

Payslip will expire every 30th of the subsequent month.

Allowances

Accepted List

Fixed Allowance

- Imbuhan Tetap Perkhidmatan Awam

- Imbuhan Perumahan

- Bantuan Sara Hidup

- Elaun Keraian

Case by Case Basis

- Elaun BI Wilayah

- Elaun Motosikal

- Elaun Menyelam

- Elaun Post Basik

- Elaun Penguat Kuasa

Rejected List

- Elaun Lebih Masa (OT)

- Imbuhan Tahunan (Bonus)

- Tunggakan (Arrears)

- Elaun Memangku

- Elaun Tanggungan

- Elaun Jahitan

- Elaun Warden

(This list will be updated from time to time)

2012-12-21: The following table no longer applicable, we will update soon.

| YEARS | MONTH | RATE | FACTOR |

|---|---|---|---|

| 2 | 24 | 5.99% | 19.26 |

| 3 | 36 | 5.99% | 28.25 |

| 4 | 48 | 5.99% | 36.38 |

| 5 | 60 | 5.99% | 43.75 |

| 6 | 72 | 4.99% | 52.81 |

| 7 | 84 | 4.99% | 59.58 |

| 8 | 96 | 4.99% | 65.86 |

| 9 | 108 | 4.99% | 71.71 |

| 10 | 120 | 4.99% | 77.18 |

| 11 | 132 | 4.99% | 82.28 |

| 12 | 144 | 4.99% | 87.08 |

| 13 | 156 | 4.99% | 91.58 |

| 14 | 168 | 4.99% | 95.81 |

| 15 | 180 | 4.99% | 99.81 |

| 16 | 192 | 4.99% | 103.58 |

| 17 | 204 | 4.99% | 107.15 |

| 18 | 216 | 4.99% | 110.53 |

| 19 | 228 | 4.99% | 113.74 |

| 20 | 240 | 4.99% | 116.78 |

- Available Deduction = (Salary x 60%) - Deduction at Payslip + Redemption (settlement)

- Loan Eligible = Available Deduction x Factor

- In Hand = Loan Eligible x 100%